Has OPEC misled us about the size of its oil reserves? The short answer is probably. The long answer is that currently, there is no way to know for sure.

The next question we should ask is: Does it matter? The answer is most definitely yes. OPEC, short for the Organization of Petroleum Exporting Countries, currently claims that its 12 members hold 81.3 percent of the world's oil reserves. And, with few exceptions the world believes them. Trouble is these reserves "are not verified by independent auditors," according to a study (PDF) done by the U.S. Government Accountability Office, the nonpartisan investigative arm of the U.S. Congress. OPEC reserves are simply self-reported by each country. Essentially, OPEC's members are asking us to take their word for it. But should we?

It ought to give us pause that the reserve numbers OPEC countries release are used in major reports produced by the U.S. Energy Information Administration (EIA); the Paris-based International Energy Agency (IEA), a consortium of 28 of the world's oil importing nations; oil giant BP which annually publishes the widely cited BP Statistical Review of World Energy; and myriad other organizations. Reports from the two agencies cited above and BP are frequently consulted by governments, industry, banks and investors around the world for policy formulation, long-term planning, and lending and investment decisions. Yet these groups seem blissfully unaware of the caveats surrounding the numbers in those reports and by extension surrounding more than 80 percent of the world's oil reserves.

Keep in mind as we go along that the sometimes astronomical numbers thrown around for world oil reserves by the uninformed or by those who intend to mislead us either have no basis in fact or actually refer to "resources." Resources are only an estimate of oil thought to be in the ground based on rather sketchy evidence. And, most of that oil will never be recoverable. Reserves, however, are what can be produced at today's prices from known fields using existing technology. It turns out that reserves are only a tiny fraction of so-called resources.

Now here's the caveat from the International Energy Agency in its World Energy Outlook 2010:

Definitions of reserves and resources, and the methodologies for estimating them, vary considerably around the world, leading to confusion and inconsistencies. In addition, there is often a lack of transparency in the way reserves are reported: many national oil companies in both OPEC and non-OPEC countries do not use external auditors of reserves and do not publish detailed results.

"National oil companies" refers to government-owned companies which typically control all oil development within a country.

The BP Statistical Review of World Energy for 2012 provides this explanatory note under a table listing oil reserves by country:

The estimates in this table have been compiled using a combination of primary official sources, third-party data from the OPEC Secretariat, World Oil, Oil & Gas Journal and an independent estimate of Russian and Chinese reserves based on information in the public domain. Canadian oil sands 'under active development' are an official estimate. Venezuelan Orinoco Belt reserves are based on the OPEC Secretariat and government announcements.

The key words are "OPEC Secretariat" which refers to the OPEC staff located in an office in Vienna. That office is where BP presumably gets its information about OPEC reserves. The EIA lists the OPEC Annual Statistical Bulletin put out by--you guessed it--the OPEC Secretariat. Alas, the Annual Statistical Bulletin tells us under the heading "Questions on data" that "[a]lthough comments are welcome, OPEC regrets that it is unable to answer all enquiries concerning the data in the ASB." In other words, trust us. So, information about OPEC reserves comes either from the OPEC offices in Vienna or from member countries. Some analysts may adjust those figures based on the few shreds of evidence that are available outside of official government pronouncements. But, in reality, there are almost no hard facts when it comes to OPEC reserves.

Strangely, many of these countries say that a detailed audit of their fields by independent observers is out of the question because oil reserves are a state secret. And, yet those countries report their reserves to OPEC which publishes them for all to see. So, are oil reserves in many OPEC countries a state secret or not? Apparently, what's secret is the field-by-field data that would tell us whether the reserves claimed by these countries are actually there. Are there reasons to believe that if we saw this data it would contradict the official overall number provided by some countries? In a word, yes.

First, OPEC allocates production levels among its members. It does this to control the flow of oil to world markets and thus to manipulate the price. OPEC bases production quotas for its members in part on the size of each member's reserves. When this policy was first established in the 1980s, reported reserves for several OPEC members jumped between roughly 40 and 200 percent within one year--not always the same year--as each country jockeyed for a higher production quota. Based on EIA data, here's what it looked like:

| Country | Reserves in Barrels (Year) | Reserves in Barrels (Year) | Percentage Increase |

| Iran | 48.8 billion (1987) | 92.9 billion (1988) | 90.4% |

| Iraq | 47.1 billion (1987) | 100 billion (1988) | 112.3% |

| Kuwait | 66.7 billion (1984) | 92.7 billion (1985) | 39.0% |

| Saudi Arabia | 172.6 billion (1989) | 257.6 billion (1990) | 49.3% |

| United Arab Emirates | 33.1 billion (1987) | 98.1 billion (1988) | 196.4% |

| Venezuela | 25.0 billion (1987) | 56.3 billion (1988) | 125.2% |

Not every country participated in the free-for-all. But the countries with the largest exports participated with a vengeance. There was no drilling program in any of these countries that could have explained such jumps in reserves.

The competition continues to this day. In October 2010 Iraq announced an increase in its oil reserves from 115 billion barrels to 143.1 billion barrels. No attempt was made to hide the reason for the increase: "Falah al-Amri, the head of the country’s State Oil Marketing Company, suggested that future quota calculations might have been a factor in the revision." A week later Iran raised its reserves number from 136.6 billion barrels to 150.3 billion barrels, presumably in order to maintain its position within the OPEC production quota system. These numbers have been dutifully included in the latest statistical compilations of both EIA and BP, as if the two hadn't gotten the memo that Iraq's and Iran's increases were reported merely for quota reasons and not because of any particular discoveries.

Perhaps even more astounding is that some OPEC members don't even take the oil reserves reporting game seriously any more. Logic dictates that there should be at least small adjustments up or down in reserves each year as new fields are developed and old ones decline. The world of geology simply cannot yield precisely the new reserves needed to replace exactly the amount of oil extracted from existing fields each year.

And yet, the United Arab Emirates has been reporting 97.8 billion barrels of oil reserves every year since 1997. Kuwait has been reporting 104 billion barrels each year since 2008. Iraq shows long periods from 1980 onward when reserves don't change, the latest running from 2004 to 2011 during which reserves supposedly held absolutely steady at 115 billion barrels. Algeria has reported 12.2 billion barrels from 2008 onward. At least Saudi Arabia has demonstrated a certain sensitivity to appearances and has adjusted its reserves number slightly from year to year. And yet, that number has remained within a narrow range of 260 to 267 billion barrels from 1991 to the present. All of these numbers suggest that depletion from existing fields is taking absolutely no toll on OPEC's reserves. Even if that's true, we have no way of verifying it.

The second reason to doubt OPEC's official oil reserve numbers is that two insiders have told us not to trust those numbers. The now deceased A. M. Samsam Bakhtiari, an executive for the National Iranian Oil Company, told the Oil & Gas Journal all the way back in 2003 the following: "I know from experience how 'reserves' are estimated in major Middle Eastern (and OPEC) countries...And the methods used are usually far from scientific, as the basic knowledge for such a complex exercise is not at hand." He estimated that Iranian reserves were about 37 billion barrels, not the 90 billion that were being cited at the time.

Back in 2007 Sadad al-Husseini, former executive vice president for exploration and production at Saudi Aramco, the state oil company that controls all oil development in Saudi Arabia, told a conference in London that world oil reserves had been inflated by 300 billion barrels. That number almost matches the increases in OPEC members' reserves for quota reasons in the 1980s, and it represented about a quarter of all reported reserves in 2007. As a result, to this day al-Husseini remains skeptical of claims that world oil production will rise much from here.

Another piece of evidence that casts doubt on OPEC members' reserve claims came to light in 2005. That year Petroleum Intelligence Weekly, an industry newsletter with worldwide reach, obtained internal documents from the state-owned Kuwait Oil Co. The documents revealed that Kuwaiti reserves were only half the official number, 48 billion barrels versus 99 billion. Since then policymakers and the public seemed to have ignored the entire incident. The BP Statistical Review lists Kuwait's reserves as 101.5 billion barrels as of 2011. The EIA shows them as 104 billion. Skepticism apparently is taking an extended holiday at BP and EIA.

Measuring oil reserves remains something of an art. Even large publicly traded oil companies with armies of petroleum geologists and engineers who operate under strict U.S. Securities and Exchange Commission rules for estimating reserves--even these companies don't always get it right. In 2004 Royal Dutch Shell had to lower its reserves number by 20 percent, a huge and costly blunder for such a sophisticated company. If Shell can bungle its reserves estimate, then how much more likely are OPEC countries which are subject to virtually no public scrutiny to bungle or perhaps manipulate theirs.

I said in a previous piece that the rate of production is the key metric when evaluating the success of the world's oil production and delivery system. But sustained production of oil depends on the size and quality of reserves. If the world does indeed have 300 billion fewer barrels of reserves than it thinks it does, that has implications for how long the current rate of production can be maintained. (It has been stuck between 71 and 76 million barrels per day since 2005.) And, that is why the mystery surrounding OPEC's reserves, which supposedly constitute 80 percent of the world's reserves, is so disturbing. Even more disturbing is how much this mystery is ignored or perhaps not understood by policymakers, industry and the public.

We shouldn't be the least bit exultant over claims that we have more oil reserves than we've ever had before. First, we are using up that oil at a faster rate than ever before. Second, much of what is currently parading as reserves may not be. Third, the plateau in worldwide oil production since 2005 is actually consistent with a smaller reserve base.

Given all this I think we can safely say that when it comes to the official statistics on oil reserves, there is likely to be less than meets the eye. And that begs the question: Does it really make sense for the world to chart its energy future based on such dubious information?

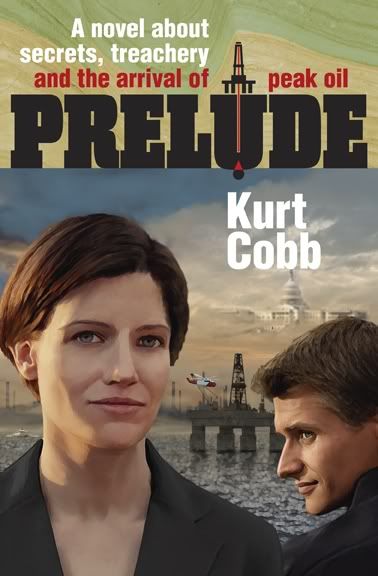

Kurt Cobb is the author of the peak-oil-themed thriller, Prelude, and a columnist for the Paris-based science news site Scitizen. His work has also been featured on Energy Bulletin, The Oil Drum, 321energy, Common Dreams, Le Monde Diplomatique, EV World, and many other sites. He maintains a blog called Resource Insights.

Kurt Cobb is the author of the peak-oil-themed thriller, Prelude, and a columnist for the Paris-based science news site Scitizen. His work has also been featured on Energy Bulletin, The Oil Drum, 321energy, Common Dreams, Le Monde Diplomatique, EV World, and many other sites. He maintains a blog called Resource Insights.

7 comments:

Hey Kurt, I saw you speak in Winona. Used to work for Ruppert before I realized there was more to the Peak Oil story than even it's most ardent proponents know about. When are you Peak Oil Gurus going to acknowledge that the same energy companies leading us down this dead end have also been suppressing technologies that could save us for over a century? Peak Oil is a part of the big lie, and a whole stable of patented "silver bullets" are collecting dust:

http://www.oilfreefun.com/2012/06/suppressed-free-energy-technology.html

http://www.oilfreefun.com/2012/03/public-service-announcement-fossil.html

To Anonymous:

Those so-called silver bullets don't return a workable EROEI.

Many are simply wishful thinking and don't hold up to the laws of thermodynamics.

No suppression has been necessary because of the above reasons; they suppress themselves.

Hello,

I find your blog to be very sane and informative, 2 rare qualities these days. Excuse me for reprinting the whole thing, but the article below appeared in my inbox today. He calls Peak Oil a hoax, but then acknowledges that oil won't last forever. I am curious if you have any comments.

Thank you,

Allen

One of the Greatest Intellectual Frauds Ever Perpetrated

By Porter Stansberry

I've written many times over the past decade that I consider Peak Oil to be one of the greatest intellectual frauds ever perpetrated.

I believe having a correct understanding of these issues is critical… perhaps the single most important economic issue of the next several decades.

This matters because if M. King Hubbert (the original Peak Oil theorist) was right in 1956 when he forecast global oil production would peak around the year 2000… we're facing a major change in the future of the energy industry.

If we're actually about to run out of oil, or if production is inevitably going to decline, we ought to be making major investments in alternative sources of energy, like windmills and solar farms – even if those technologies are terribly expensive. Likewise, if we're really about to run out of oil, spending huge sums of capital to dig up most of Alberta (for oil sands) and mandating electric cars might be sensible policies.

Investors face an even more basic question: If oil production is inevitably doomed to recede, isn't the future price of oil likely to be drastically higher?

On the other hand, if M. King Hubbert is wrong (and I believe he was catastrophically, even laughably, wrong), perhaps we're wasting billions of dollars in capital pursuing energy solutions that aren't practical, economic, or… in the case of photovoltaic semiconductor (PV) solar… physically possible.

If the production of oil is more likely to greatly increase over the next 50 years, perhaps investors ought to be cautious about assets that require high oil prices to be economic.

Most important… if we're not really going to run out of oil… perhaps we ought to be leery of corporations and their partners in government that want to tie us to energy products and policies that aren't in our ultimate best interests. We should be on guard for ideas that will handicap us with higher energy costs for the next several decades.

Just imagine how the Germans and the Spanish will feel when they realize the PV solar panels from First Solar that they spent billions of dollars on don't work. Not only that, but the plummeting price of natural gas made them completely unnecessary.

That's why M. King Hubbert's theory matters. And that's why I'm so passionate about these ideas.

Allen,

Thanks for your kind words about my writing. I've deleted much of the article you cited. But I do want to respond.

I'd prefer in the future that you find a link and link to it in your comment.

I've written about Porter Stansberry in the past, and he always uses the same canard. Those concerned about peak oil say that we are going to "run out". Of course, we never say that. We say that the rate of production is going to decline. Stansberry shows his hostility for every form of renewable energy whenever he writes and it makes me believe that he is nothing but a shill for the oil industry.

The article you cite is virtually fact-free. And, he puts words in the mouths of those concerned about a near-term peak but cites no actual person who said them. I think he's just making it up! He creates pretend arguments that no serious person concerned about peak oil would make these days. He harps on M. King Hubbert, but is careful to avoid mentioning Ken Deffeyes, Jean Laherrere or Colin Campbell who significantly refined and expanded Hubbert's methods and provide a much more nuanced picture of the peak.

And, Stansberry doesn't address the plateau in production which is now in its seventh year despite high prices. He tells us that high prices will solve the problem. But they haven't.

Whom should we believe then? Someone who has been wrong seven years straight? Or the geologists who predicted that world oil supplies would likely stop growing around 2005?

We might hit a nominal new peak in the future. But we now appear to be on a plateau in production. The big question is when we might fall off that plateau.

I acknowledge the possibility that technological breakthroughs might increase the rate of production beyond the current plateau and even significantly and for an extended time. Anything is possible.

The question is whether Stansberry's very poor record with regard to oil supply prediction ought to be the basis for our energy policy.

There are lots of reasons for human societies to move beyond oil: pollution, climate change, geopolitical threats to supply. But an oil peak will trump them all if it comes soon.

Stansberry's solution is for us to simply have faith. I for one do not recommend his faith-based energy policy to anyone based on the actual data and the tremendous risks we face if he's wrong.

Hi Kurt!

I found your blog via the Energy Bullentin.

I read your previous post for the CSM and began to search for more of your commentary and stumbled upon your piece on the validity of counting NGLs/NGPLs as oil.

After having read that last piece I was pretty amazing by your grasp of the technical aspects.

The added benefit is that you're a gifted writer, so not only did you come across as knowledgeable (if not more) than some of the geologists on Peak Oil that I've read, you're mastery of the English language made it a pleasure to read.

I've been following the Peak Oil story since about the year 2010, so all these names in the community I recognize, but many battles fought I do not. One such is the fight over the OPEC oil reserves.

I've read about it but only in passing. I haven't come across as lucid (and well-sourced!) an explanation as yours.

My somewhat prolonged point is that even if you, and other writers on this topic, may assume that everyone has all the details on this issue, a lot of people are starting to flood in these past 2-3 years as it's obvious that our economies do not grow fast enough and our generation, the young, are very environmentally aware.

Therefore Peak Oil becomes a novel concept and many issues which many in the community may assume is a given, is in fact not as well understood by the newcomers like myself, as it is among the more experienced community members.

Therefore I hope that you write about issues like these, which may seem esoteric in of themselves, but have a strong and valuable function to ground a lot of new, and younger, people who are just discovering the story.

And your voice is needed, because you're a very intelligent man, and you're a great writer at that.

If I could show my friends your reasoned writing on all the basic concepts on Peak Oil, instead of having them contend with the crazies like Kunstler or Ruppert, then they are going to have a much better understanding after having their intellectual thirst awakened by a mini-documentary or a brief conversation with someone who introduces them to the topic.

I hope I made sense!

Kind regrads,

David.

David,

Thank you for your kind words. The series I'm doing to introduce CS Monitor readers to my blog is designed to do just what you describe as necessary to introduce those who are delving into peak oil and related energy and environmental issues for the first time.

I hope with this series and many future posts to continue to write in a way that is accessible to first-time readers while also providing longtime readers with a fresh angle or insight on our predicament.

That will be quite a balancing act. But it is one way that I believe I'll be able to reach those who are just becoming aware of our situation and want to understand it better.

Another way I'm trying to reach those who are just becoming aware of peak oil and even those who know absolutely nothing about it is my novel, Prelude. My hope has been that activists would find the story compelling enough that they would recommend it to those they want to introduce to the topic. This is starting to happen, and I am hopeful that it will continue.

Also, I am grateful to a newfound Hollywood contact who has produced a screenplay based on the book and is currently shopping it around to producers and directors who might be interested. Peak oil on the screen in the form of a romantic thriller could create a huge jump in awareness.

Has America completely lied to itself in referring to the first oil shock as the "Arab embargo" ?

Definitely yes.

The first oil shock was about :

- Producing countries wanting to get a bigger pie of each barrel revenues and start producing on their own.

- The 1971 US production peak (which amongst other things meant western majors needed a higher barrel price to start Alaska, GOM, North Sea, and keep a higher market share in the process)

- Common interest or "deal" to raise the price between US diplomacy/majors and OPEC

- The embargo a complete epiphenomenon that lasted 3 months and wasn't even effective from KSA to the US

Then you had the raising reserves period within OPEC (and counter oil shock), which was about the OPEC internal rule of having the yearly quotas proportional to the reserves.

Counter oil shock which was also about Reagan dealing with the Saudis for them to increase their prod and bring the USSR down, and it worked.

Today what do you have ?

Most probably 98% of US "citizens" don't even know that the US went through its oil production peak in 1971

Note : comment also posted at Energy bulletin.

And about the "game" around oil diplomacy, clearly a key text is James Akins paper from 1973 :

http://www-personal.umich.edu/~twod/oil-ns/articles/for_aff_aikins_oil_crisis_apr1973.pdf

Also don't forget that prior to nationalisation, Aramco was part of standard oil (or Exxon now), so if somebody has a good idea about Saudi reserves in particular ...

Post a Comment